Aug 1, 2025

By Agnes L. DeFranco, Ed.D., CHAE, CHIA, CAHTA, CHE, Professor and Conrad N. Hilton Distinguished Chair, AHLEI Author

Selling More Rooms = Making More Money: When Is This NOT True?

This is always an interesting question because as hotel owners and managers we all want to maximize our revenues and make more money for our business. So, “if we sell more rooms, we should be making more revenue” should always be a true statement, right?

Like many answers, the answer to this question is also, “It depends.” It does make sense that when we sell more rooms, we should make more revenue. However, it really depends on the “price” we sell the rooms at – that is what revenue management is all about! And, that is expressly why it is always prudent for hotel managers and owners to perform a revenue variance analysis.

What is a revenue variance analysis? When the projected or budgeted revenue is not the same as the actual revenue, you want to know not just by how much, but you want to know WHY! Variance analysis is the process of analyzing the differences between what is planned and what is the actual performance. With such an analysis, management and owner will be better prepared to identify the root causes of such differences.

Let’s take a look. To begin, a revenue variance is made-up of three parts: price variance, volume variance, and also the interaction of the price-volume variance. The formulas of each of these three variances are listed below, and together they add up to be what is known as the revenue variance:

To bring this to a more concrete discussion, I would like to offer three examples to illustrate why a revenue variance analysis can shine a light on how we should sell rooms and more importantly, at what price points.

1. Selling more rooms at a higher price

In this first example, a hotel sells more rooms, and also selling them at a price that is more than what was expected. Yes, if both rooms sold and price have a positive increase, the hotel will make more revenue. The final difference in revenue is $8,750. When a revenue analysis is conducted, we can see that the price difference of $5 (from $130 to $135) only contributes $2,000 of the total $8,750 of increase in revenue.

The biggest reason why the hotel enjoys this huge favorable variance is because of the volume of rooms that is sold, and that contributes $6,500 to the increase.

Finally, the interaction effect of the price and volume together contributes a mere $250 to arrive at the total effect of the $8,750 favorable variance ($2,000 + $6,500 + $250)

So, under these circumstances, the statement of “selling more rooms equates to making more revenue” is true.

2. Selling more room at a lower price

Let's now look at the second example where we still sell more rooms, but we are selling them at a price that is less than what is budgeted. In this case, the actual price is $5 less than the budgeted price. And luckily, the statement still holds true, because the variance is still at a favorable variance of $4,250.

When parceling out the three parts, you can see that the volume variance is still $6,500. However, because we are selling the rooms at a price that is less than budgeted, the price variance actually hurt the total variance at an amount of -$2,000. And because of the negative price difference, the price-volume variance is also affected, and becomes a negative number at -$250. When everything is added up, the total variance, although is still a positive $4,250, is a lot less than the first scenario where the total variance is $8,750.

3. Selling more room at a much lower price

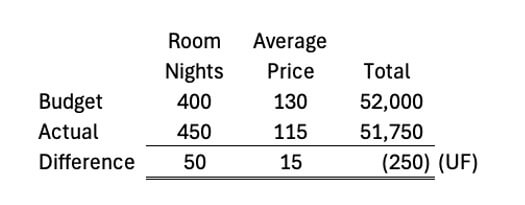

In some cases, when hotels want to sell more rooms, they lower the room rate as an incentive. So, in this third scenario, we still sell more rooms. However, with a price drop of $15 per room, the revenue variance now becomes a negative number, or an unfavorable variance, at -$250! So, the hotel did sell more rooms, but it is NOT making more revenue!

Again, when we segregate out the three components and dig deeper, from the volume variance, we are still at a positive $6,500, just like the first two scenarios. However, the price that the rooms are sold was not the $130 as expected but at $115, which is $15 less than the budgeted price! A $15 price drop may not seem much at first glance, but the effect is detrimental.

With selling 50 more rooms, the hotel still enjoys a volume variance of $6,500. But, that price drop of $15 per room pulls the total variance down by $6,000 (or -$6,000). And together with the price-volume variance of another negative at -$750, the total revenue variance is now an unfavorable variance of -$250. This is not what any hotel would like to see. In this case, selling more rooms absolutely does not equate to making more revenue!

Revenue Variance: A Must!

Just doing a quick revenue variance analysis, a lot more detail information surfaces. Management can set these three variance formulas in a simple Excel sheet. Then, play with the numbers by substituting the actual price from $130 and decrease it dollar by dollar, and see at what price level will the hotel still be able to meet budget, or how many more rooms does it have to sell to achieve a certain desired level of revenue. Revenue variance has a very important place in hotel management. Give it a try.

More detailed information and other examples can be found in Chapter 10 Operations Budgeting in Hospitality Industry Managerial Accounting.

By Agnes L. DeFranco, Ed.D., CHAE, CHIA, CAHTA, CHE, Professor and Conrad N. Hilton Distinguished Chair, AHLEI Co-Author of the Ninth Edition of Hospitality Industry Managerial Accounting.